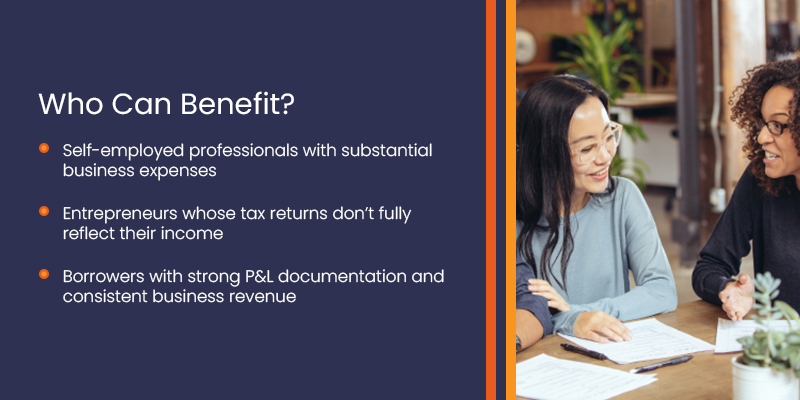

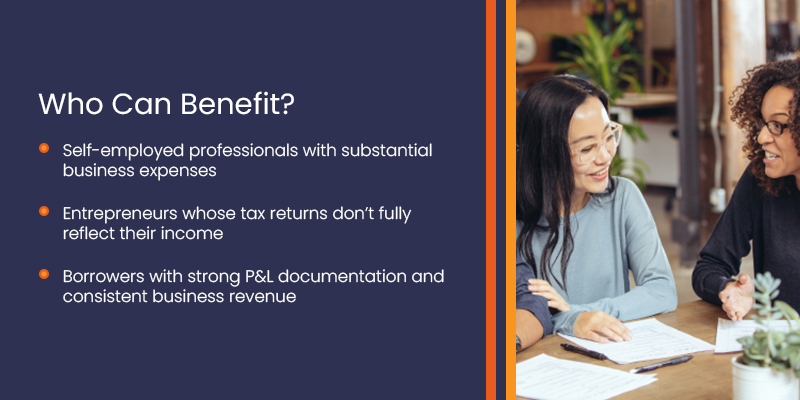

At DMV Residential Financing, we’re redefining mortgage solutions for self-employed borrowers with our Profit & Loss (P&L) Statement Loan. This program uses CPA-certified P&L statements to verify income, eliminating the need for traditional documentation like tax returns or W-2s.

Designed for entrepreneurs and business owners, this loan provides flexibility and a straightforward qualification process. Let DMV Residential Financing simplify your journey to homeownership while honoring your financial independence.

At DMV Residential Financing, we’re redefining mortgage solutions for self-employed borrowers with our Profit & Loss (P&L) Statement Loan. This program uses CPA-certified P&L statements to verify income, eliminating the need for traditional documentation like tax returns or W-2s.

Designed for entrepreneurs and business owners, this loan provides flexibility and a straightforward qualification process. Let DMV Residential Financing simplify your journey to homeownership while honoring your financial independence.

Qualify with a 12–24 month CPA-certified P&L statement

Flexible down payment options (10–20%) based on your financial profile

Competitive rates for borrowers with a minimum 620 credit score

Focus on actual business performance rather than net income on tax returns

Qualify with a 12–24 month CPA-certified P&L statement

Flexible down payment options (10–20%) based on your financial profile

Competitive rates for borrowers with a minimum 620 credit score

Focus on actual business performance rather than net income on tax returns

Streamlined underwriting with a team experienced in investment property financing.